Pushpendra Mehta, CTMFile

As troubled US bank First Republic is snapped up by JPMorgan Chase in another bank failure, a recent survey reveals a sharp spike in awareness of concentration and counterparty risk amongst corporate treasurers.

Corporate treasury professionals grapple with the complexity of analysing their entire investment portfolio, which may include bank balances and deposits, internally managed investments, money market funds, bond funds and separately managed accounts. This is because a comprehensive analysis necessitates a holistic view of the investment portfolio.

A groundbreaking solution has been introduced by ICD, a trusted provider of institutional investment technology that analyses and reports on all the investments across the entire portfolio of treasury practitioners.

In a press release, ICD said that “Corporate treasury professionals who struggle to get a comprehensive view of their entire investment portfolio will now be able to automate the otherwise time-consuming process with a new, AI-driven cloud investment reporting solution, ICD Portfolio Analytics.”

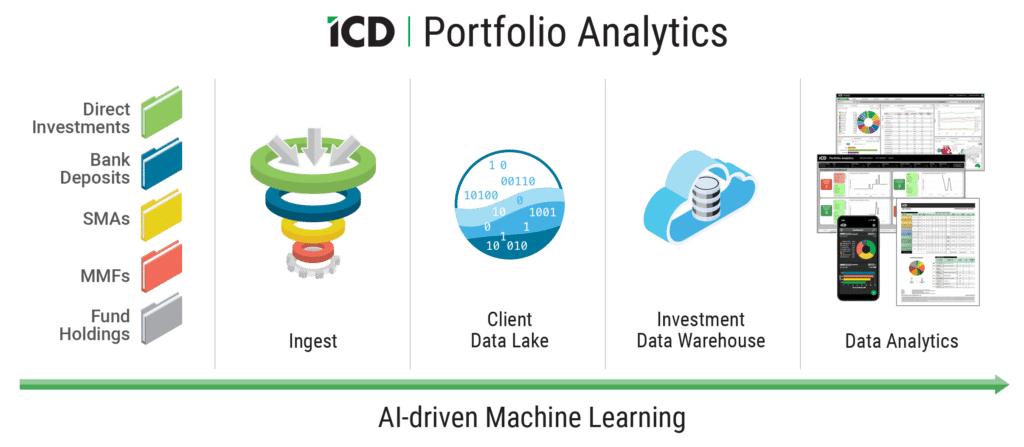

Launched at the annual conference of the Association for Financial Professionals (AFP) in San Diego, California, United States, on Monday, ICD Portfolio Analytics solution employs its proprietary process to automatically ingest data from a variety of reporting sources such as custodians, asset managers, enterprise resource planning (ERP) systems, treasury management systems (TMS), banks and other data sources, which come into the organization in disparate or different file formats.

Utilising machine learning (ML), the solution aggregates and harmonizes the data, storing it in a normalised database for subsequent analysis and reporting.

Expressing his support for ICD Portfolio Analytics, Indivior Treasurer Bill Lundeen said, “ICD Portfolio Analytics incorporates our underlying fund holdings with other investment positions, making it possible to see our true exposures across all of our investments.”

“This is invaluable given the heightened focus on exposures due to the 2023 bank failures”, Lundeen added.

ICD Portfolio Analytics comes at a time when counterparty credit risk has been thrust into the spotlight following the banking crisis triggered by the failure of Silicon Valley Bank (SVB) in March 2023.

Earlier this year, 86% of clients responding to ICD’s annual survey expressed their concerns regarding counterparty credit risk.

Keeping in mind the concerns of its treasury clients, ICD designed its AI-driven cloud investment reporting solution with the ability to assess portfolio risk in multiple dimensions and delve into granular detail for actionable insights on counterparty exposure, ratings distribution, geographic exposure, and more. Additionally, with ICD Portfolio Analytics configurable dashboards, treasury teams can visualise positions and monitor their entire portfolio against investment objectives and risk tolerance.

According to ICD, “ICD Portfolio Analytics employs proprietary technology to automate the aggregation of disparate holdings data, machine learning to normalize raw data captured and stored in a client specific data lake, a client specific data warehouse to save portfolio data for analysis and reporting, and report generation tools to deliver a comprehensive view of portfolio concentration, exposure, available headroom and post-trade compliance.”

“We’re solving real problems for organizations that are spending precious resources on low-value work,” commented Zachary Brown, ICD’s Executive Vice President of Investment Reporting. “Currently, organizations are struggling to consolidate and normalize holdings information using spreadsheets and home-grown tools. Their manual process often results in incomplete and delayed views of their investment portfolios, which in turn hampers decision-making and masks compliance violations and exposures.”

Aside from offering companies easy information on counterparty, country, sector, ratings and maturity exposure, the comprehensive nature of this data set enables organizations to ensure their portfolio aligns with their firm’s compliance rules and investment guidelines.

ICD Portfolio Analytics builds upon ICD’s two-decade history of collaborative innovation with clients, focusing on solving the investment-related challenges faced by corporate treasury executives, while harnessing powerful analytics for proactive investment decisions and reporting.

CTM News Team

In this WEBchat, Craig Jeffery and Zachary Brown have a discussion on ICD Portfolio Analytics. Discover how this AI-driven solution is transforming corporate treasury reporting, automating processes, and providing a comprehensive view of investment portfolios in light of heightened concerns about counterparty credit risk.

Speakers:

Craig Jeffery

Founder and Managing Partner of Strategic Treasurer

Zachary Brown

Executive Vice President, Investment Reporting, ICD